Member support

Manage your health the easy way. We’ve gathered tools, documents and resources to help you find what you need in 1 place.

Have you activated your MyHumana account? Get started now to view all of your plan information online.

Manage your health the easy way. We’ve gathered tools, documents and resources to help you find what you need in 1 place.

Have you activated your MyHumana account? Get started now to view all of your plan information online.

Important information for our D-SNP plan members: If you received a notice in the mail saying that you are no longer eligible for your Humana health insurance plan, we’re here to help. Don’t let your benefits lapse. Visit

Setting and achieving health goals may help you feel happier, healthier and more energized. Check out our fun and rewarding benefits and programs offered on certain Humana Medicare Advantage plans.

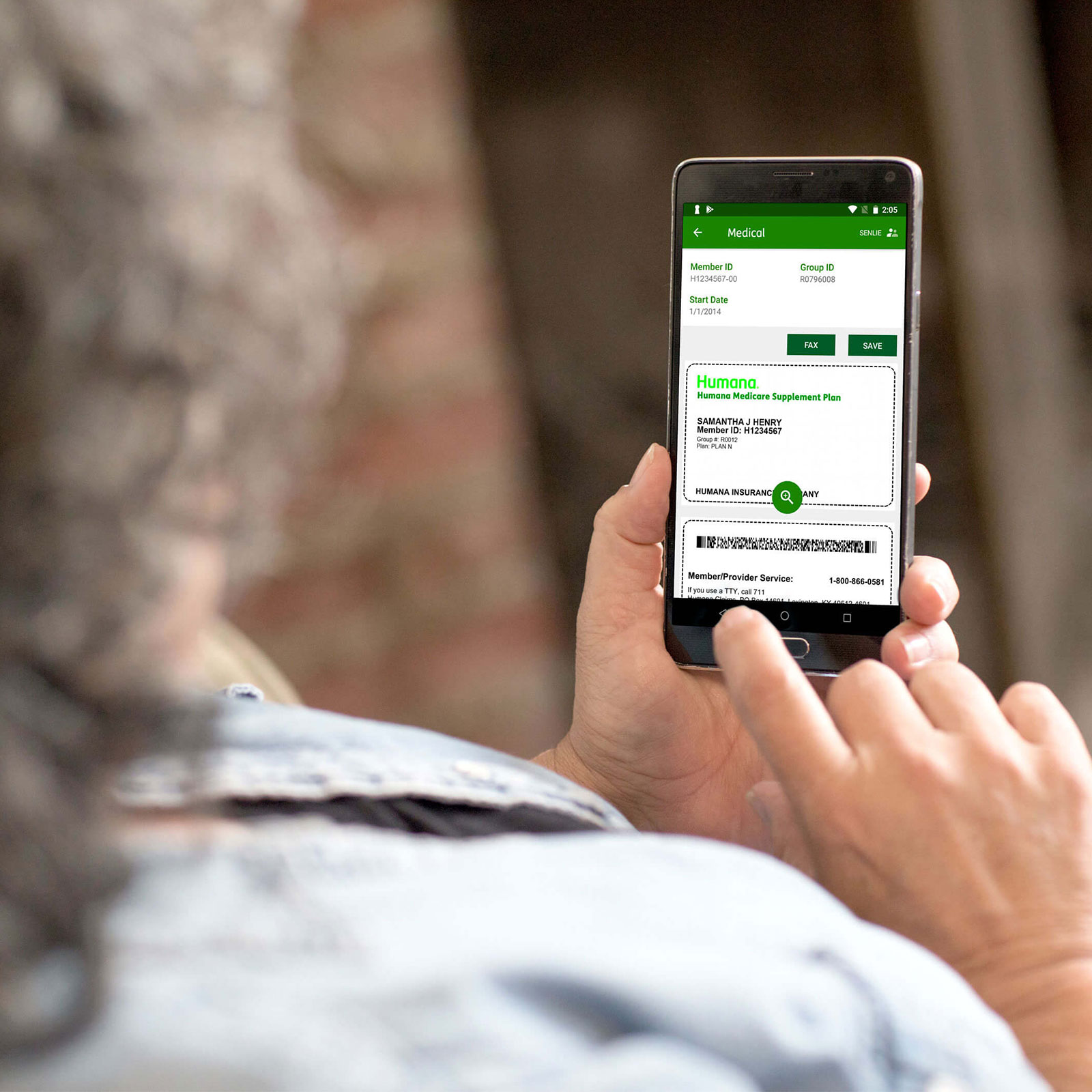

Access mobile apps to explore your plan benefits, review prescription drug options and check your claims quickly and easily. Not all apps are available for Medicare members.

Can’t see your regular healthcare provider in person? Some in-network providers offer virtual care at home or on the go.

We created a guide to help you better understand some of the terms and provisions in your Humana insurance plan. This guide does not apply to Original Medicare or Medicaid plans.