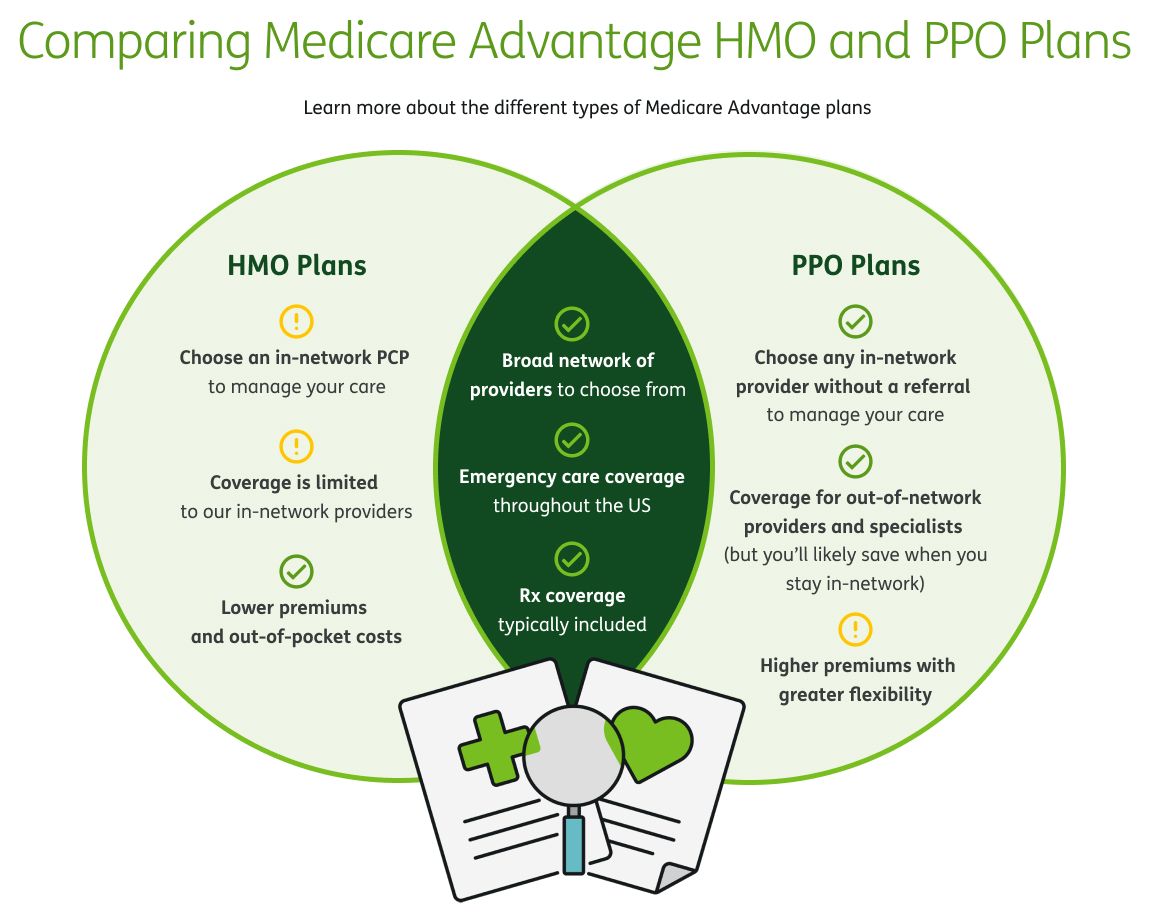

There are a lot of decisions to make when it comes to choosing a health insurance plan. One of the first decisions you will need to make is which type of plan is right for you.

You’ve probably heard the terms health maintenance organization (HMO) and preferred provider organization (PPO), but do you really understand the differences between them?