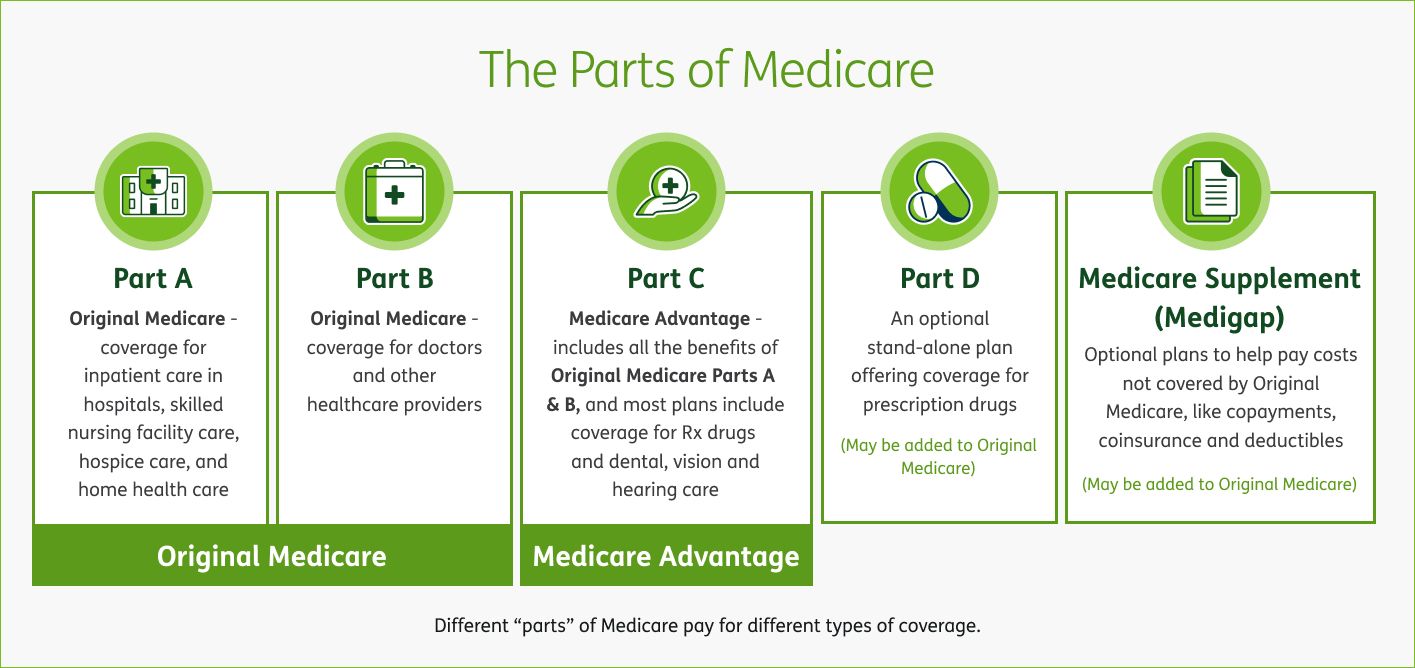

Medicare Supplement insurance plans , also known as Medigap plans, help pay for out-of-pocket costs Original Medicare doesn’t pay, such as copayments, coinsurance and deductibles. There are 10 different types of Medicare Supplement plans offered in most states. The plans are named by letters: A, B, C, D, F, G, K, L, M and N. Plans with the same letter can be sold by different insurance companies at different prices.

What do Medicare Supplement plans cover?

Each Medigap plan provides a range of benefits to help you choose the best plan for your needs.

Some basic benefits include:

- Part A coinsurance and hospital costs up to an additional 365 extra days after Medicare benefits are used

- Part B coinsurance or copayment

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

Additional benefits in certain plans may include:

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible

- Part B excess charge

To see the different types of Medigap plans and what each plan covers, explore these details on Medicare Supplement plans .