Medicare Open Enrollment Period

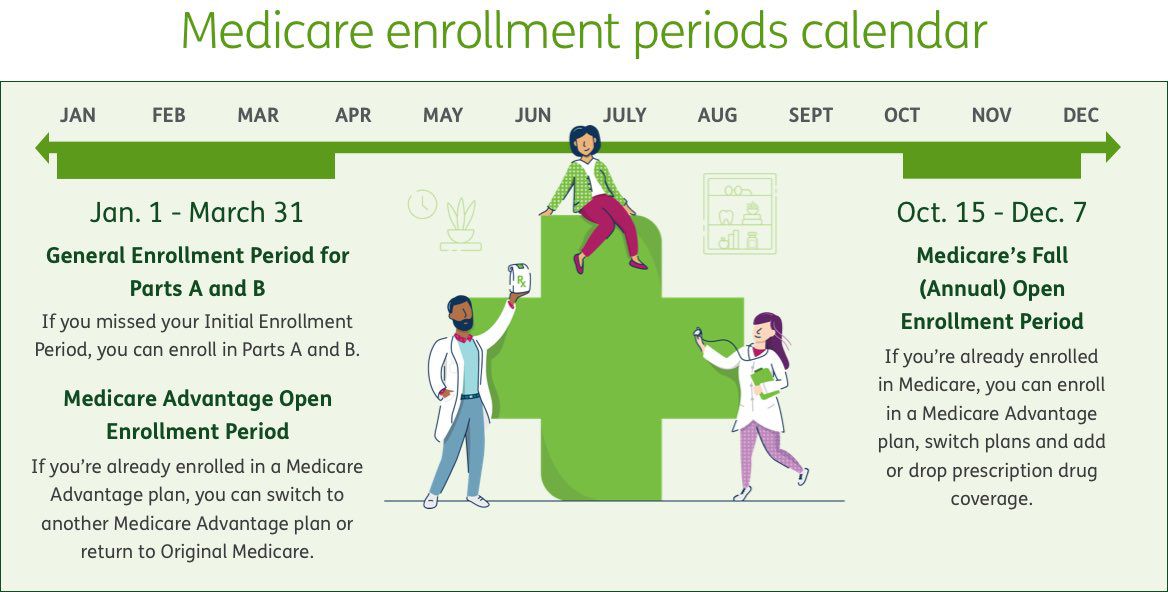

Medicare plans can change each year—including cost, coverage and networks. Medicare’s Open Enrollment Period , known as the Medicare Advantage and Prescription Drug Plan “annual election period” or “annual enrollment period” takes place each year from Oct. 15 through Dec. 7. Coverage changes start on Jan. 1 if the plans gets your request by Dec. 7. This is the primary time when people with Medicare can choose a plan, but there are other times during the year that may be called “open enrollment” or “special enrollment” periods when a person can enroll in a plan, which are explained in more detail below.”3

Dates: Oct. 15–Dec. 7

During Medicare Open Enrollment, you can:

- Switch from Original Medicare to a Medicare Advantage plan, or vice versa

- Join a Medicare Part D prescription drug plan

- Switch from a Medicare Advantage plan with drug coverage to a Medicare Advantage plan without drug coverage, or vice versa

- Change Medicare Part D prescription drug plans

- Disenroll from a Medicare Part D prescription drug plan

Additional information:

- Your coverage will begin on Jan. 1 (if the plan gets your request by Dec. 7)

Medicare Advantage Open Enrollment Period (MA OEP)

If you already have a Medicare Advantage plan, the Medicare Advantage Open Enrollment Period is when you can enroll in another Medicare Advantage plan or go back to Original Medicare. However, you can only make 1 change within the period, and other rules apply as well.3

Dates: Jan. 1–March 31

During the Medicare Advantage Open Enrollment Period, you can:

- Switch to another Medicare Advantage plan, with or without drug coverage

- Switch back to Original Medicare, and if needed, add a Medicare Part D prescription drug plan

Additional information:

- Changes take place the first day of the following month after the enrollment request is received

General Enrollment Period (GEP)

If you miss your chance to apply for Original Medicare during your IEP , or you weren’t automatically enrolled, the Medicare General Enrollment Period is your chance to sign up for Medicare Part A and Part B.3

Dates: Jan. 1–March 31

During the General Enrollment Period, you can:

- Sign up for Medicare Part A and Part B

Additional information:

- Coverage will start on July 1

- You may have to pay a late enrollment penalty

Special Enrollment Period (SEP)

A Special Enrollment Period is your chance to make changes to your Medicare coverage outside of the Open Enrollment Period when certain events happen in your life.3

When do you qualify for a special enrollment period?

Certain life events may qualify you for a SEP. These can include:

- Losing your existing coverage

- Moving

- Your Medicare plan changed

- Ability to get other healthcare coverage

- Your eligibility changed

Dates: The length of your SEP can vary depending on the type of qualifying event.

- Generally, your SEP will last 2–3 months, depending on the time of the qualifying event

- Your SEP to sign up for Medicare Part B lasts 8 months after your employer health coverage ends

During a Special Enrollment Period, you can:

- Sign up for Medicare Part A and/or Part B if you delayed coverage due to employment

- Make changes to your Medicare coverage, including Medicare Advantage and Medicare prescription drug coverage